Congress must take immediate action to curb housing challenges

By Colin Allen, executive director of the American Property Owners Alliance

June 13, 2024

Years of underbuilding and underinvestment in housing have led to a pervasive national housing affordability crisis. Today, about 50 percent of homeowners and renters struggle to afford their housing costs.

The federal government should do more to expand affordable housing, and with common-sense solutions on the table, the time for action is now.

Housing challenges weigh heavily on renters, buyers and homeowners and could impact how many individuals vote come November. In fact, nearly 60 percent of respondents to our recent survey say they will consider a candidate’s stance on addressing the rising cost of rentals and homes in this year’s presidential election.

It’s clear our leaders cannot avoid the issue any longer. We must advance solutions to curb the housing crisis once and for all.

Improving affordability

The escalating cost of living is outpacing wage growth at an alarming rate and now housing is the largest expense for American households. So it’s no surprise that one-quarter of Americans say factors preventing them from feeling financially secure include a lack of housing affordability and renting instead of owning a home.

People are sharing their experiences with rising housing costs through our interactive #OurHousingStory campaign to highlight the real impact of housing challenges, beyond the statistics. For example, Brenda R. of Pennsylvania said, “The cost of housing is astronomical, and a huge part of our community cannot afford safe housing. We need workable solutions to this housing crisis, and we need our legislators to rise up and lead the charge.”

Brenda’s not alone. According to our survey, only 17 percent of respondents think the current level of federal government involvement in expanding affordable homes and rentals is sufficient.

Common-sense solutions exist to curb rising housing prices and increase supply, and they have support from the majority of the Americans we surveyed:

- 68 percent of respondents support a federal policy that creates a federal tax credit to incentivize the development and renovation of affordable family homes in urban, suburban and rural areas most in need of investment in housing. The Neighborhood Homes Investment Act would do just that, putting 500,000 family homes on the market in the next decade.

- 78 percent of respondents support a federal policy that incentivizes developers to convert unused office space into affordable residential apartments. The Revitalizing Downtowns Act would make this possible, encouraging businesses to invest in downtown markets and requiring at least 20 percent of the residential conversion to be affordable homes and rentals.

- 67 percent of respondents support a federal policy that expands a current federal tax credit to incentivize developers to build affordable homes and rentals in their community. Increasing the existing Low-Income Housing Tax Credit would broaden these opportunities for public and private investment in the creation of affordable housing and help strengthen local economies.

When it comes to housing, increasing America’s stock of affordable homes and rentals is just one part of the solution to curbing today’s challenges. Bolstering direct support for families and individuals looking to access these properties is another.

Aiding first-time buyers

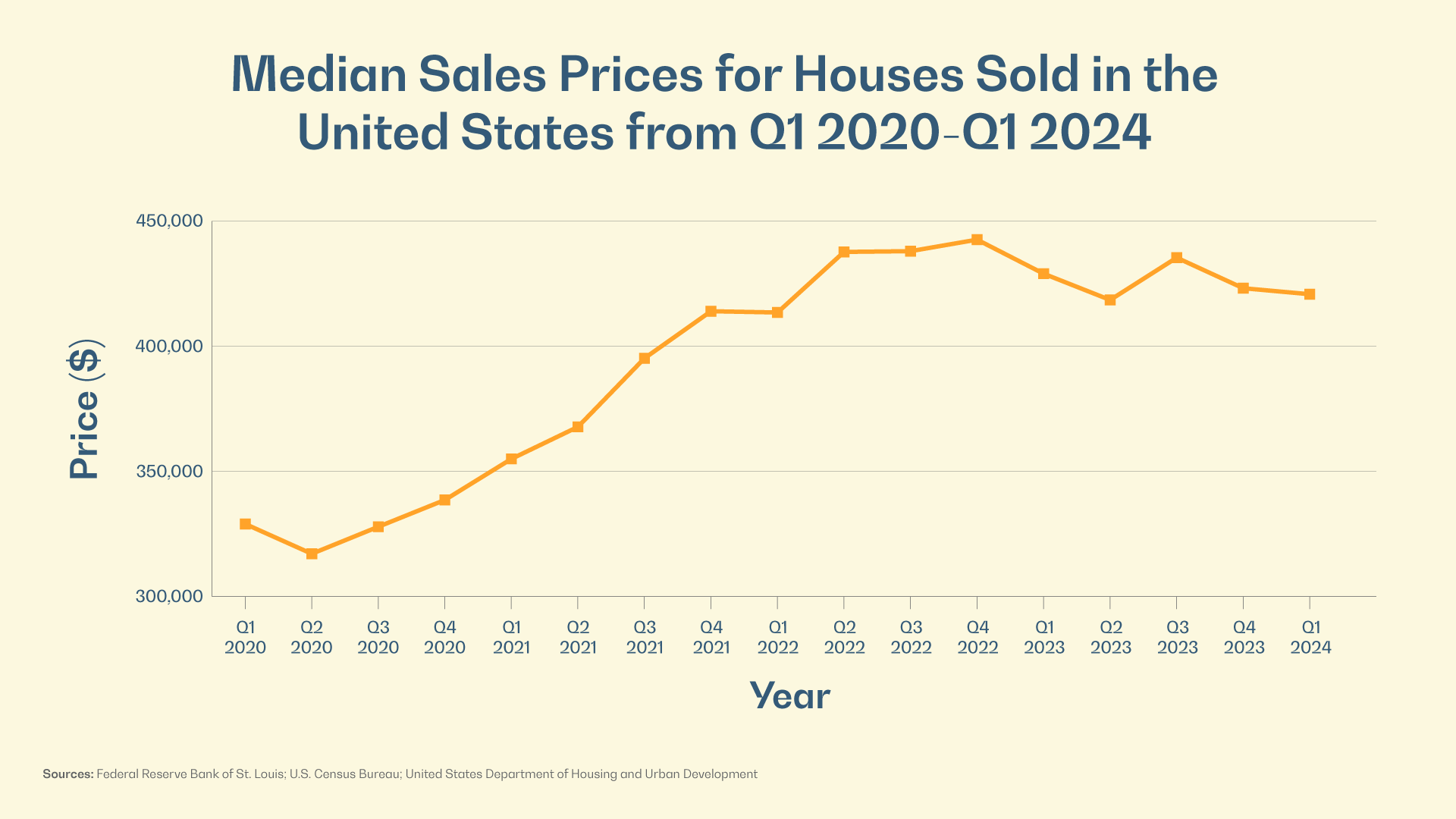

Rising home prices, low inventory and fluctuating mortgage rates challenge today’s first-time homebuyers. If that weren’t enough, competitive, all-cash bidding coupled with investors buying large portions of residential properties as profit-making ventures keep many hopeful homeowners on the sidelines.

As Kathyrn W. of Arizona shared through #OurHousingStory, “We bought our four-bedroom, two-story new-build house in 2015 for $220,000. Six years later, our adult daughter paid $300,000 for a 30-year-old, one-story, two-bedroom house that’s less than half the size of ours…Her house is about a mile from ours…[The] local government is not encouraging affordable housing to be built in our community. Their philosophy seems to be that it’s better to build high-priced homes and expensive rental properties that trap potential homebuyers in a never-ending rent cycle.”

Action to curb rising housing costs isn’t enough to improve equitable access to homeownership. We must also increase support for first-time buyers. This starts with advancing housing policy solutions that will expand pre- and post-purchase consultation for buyers, implement alternative credit modeling to support equitable access to mortgage loans and create a combination of down payment assistance and incentives for current owners to sell to first-time buyers.

In fact, about 73 percent of those we surveyed support a policy that expands down payment assistance for first-time buyers.

Yet, the need for support doesn’t end once the keys are acquired and the boxes are unpacked. Strengthening and protecting homeowners’ rights is key to safeguarding the value of homeownership for years to come.

Protecting the equity built through homeownership

Homeownership directly contributes to local communities and the economy through property tax dollars that support schools, first responders, public parks, critical infrastructure and more.

The federal government created property owner tax incentives because they recognized these valuable contributions. Yet, over the years, these incentives have been chipped away, placing an unfair tax burden on property owners.

The current cap on state and local tax deductions increasingly impacts lower- to middle-class homeowners who face rising property taxes. By restoring the deductions, we can relieve the growing tax burden and help households keep their investment protected.

It’s time for action

Each June, America recognizes National Homeownership Month as a celebration of the value homeownership brings households, communities and the American economy. Now, this month serves more as a reminder of the critical need to address the pressing housing issues burdening Americans today.

To continue celebrating homeownership and providing future generations equitable access to its benefits, we must push forward common-sense, pro-housing policy solutions to address housing issues at all levels.

By increasing the supply of affordable homes and rentals, expanding assistance for first-time buyers and strengthening property owner protections, we can do just that.

Now is the time for Congress to show their support.

Learn more at PropertyOwnersAlliance.Org.

The content is paid for and supplied by advertiser. The Washington Post was not involved in the creation of this content.

Content From