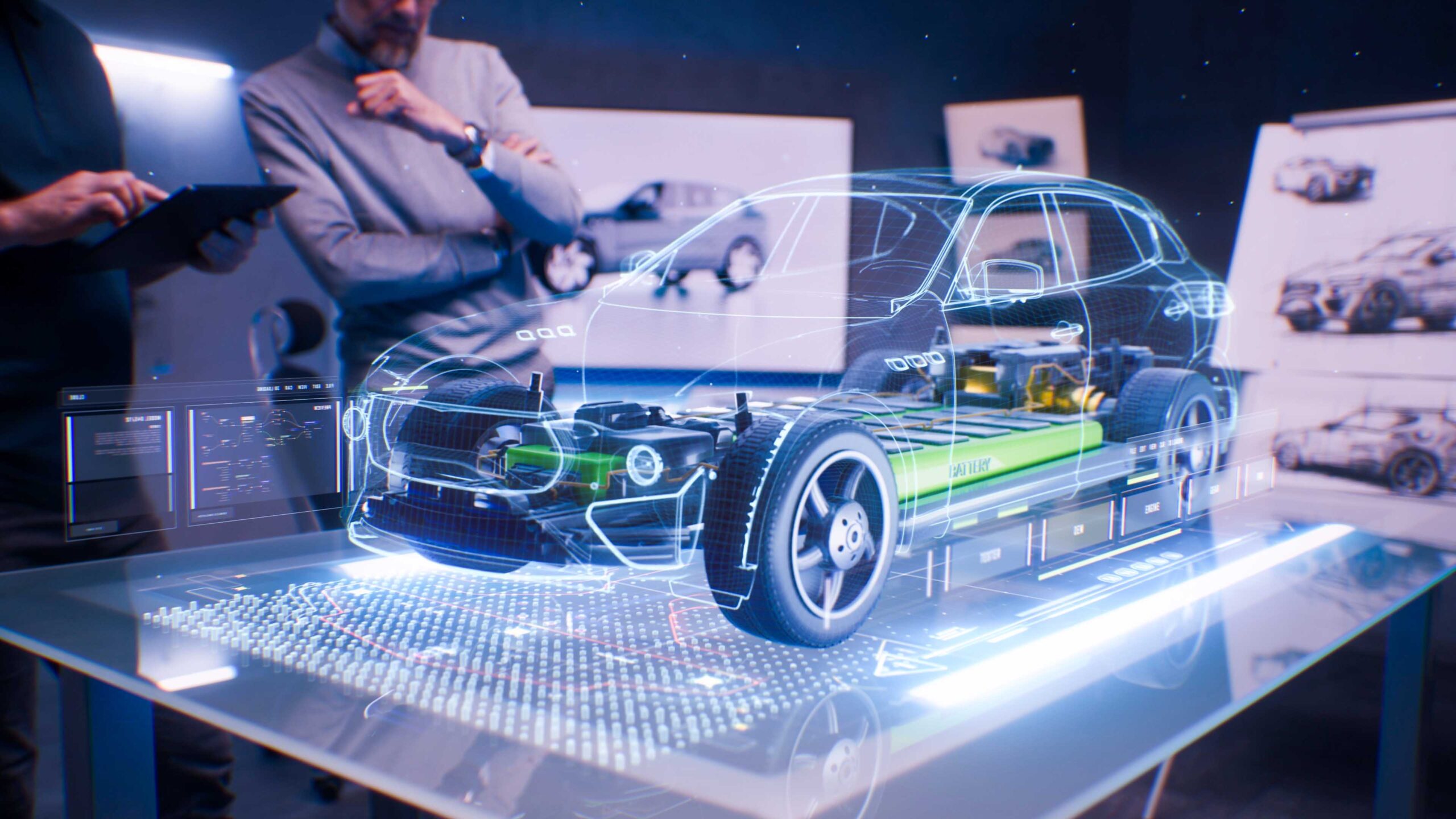

The Great Inflection Point

A look into the future of cars

By Ignacio Louzan, International Business Journalist, Investment Reports

This content is paid for and supplied by Investment Reports, a media company that generates reports for business leaders.

The Washington Post newsroom was not involved in the creation of this content.

From the assembly line to the showroom, the automobile industry has been an integral part of modern society for over a century. However, recent developments such as the increasing demand for electric and autonomous vehicles in a shift towards sustainability have forced the industry to adapt and transform like never before. Only in 2023, electric car sales worldwide are expected to leap by 35%, reaching the all-time record of 14 million.

“The one main constant in this industry is that everything changes all the time,” as Martinrea’s CEO, Pat D’Eramol, tells us. It is a complex sector characterized by fast-paced developments, and that has been shaping society in terms of transportation, job creation, and technological innovation in ways that the general public might struggle to grasp firmly. In this report, we bridge experts and the wider public on the main tendencies marking this epoch of the automobile industry, gathering insights from over 100 industry leaders across North America.

Michigan is the place that put the world on wheels in many respects. While we are not immune to the talent gap challenge, we are incredibly well suited to offer a solution.

Quentin L. Messer

Mexico ranks 7th in car manufacturing and 5th in car exporting worldwide. We export 90% of our production, with 80% of the vehicles being shipped to the U.S. and Canada.

José Zozaya

President, AMIA (The Mexican Association of the Automotive Industry)

Policy drives change

The shift towards electric vehicles (EVs), software-defined vehicles, and automation is not just driven by consumer demand. Governments around the world are incentivizing these technologies, and are to a large extent the engine of this transition – particularly when it comes to electrification in North America. Here, several states and provinces have set targets for EV sales, and introduced tax incentives for buyers. Perhaps most notable among policies is the recent Inflation Reduction Act (IRA). With a staggering sum of nearly $738 billion, the provisions within the IRA allocate a substantial $391 billion solely for the advancement of clean energy, encompassing diverse sectors such as manufacturing, recycling, carbon capture, and power generation.

Among these provisions, a noteworthy $13 billion is devoted to electric vehicle tax credits. The act is hence poised to have a significant impact on the automotive industry, whereby individuals who purchase a qualifying new EV between now and 2032 can receive a tax credit of up to $7,500. However, the impact of the IRA extends beyond individual consumers to encompass commercial entities and government agencies. These organizations can take advantage of a substantial tax break of up to 30% of the vehicle sale price or $40,000. This provision aims to entice businesses and government bodies to update their vehicle fleets with battery-powered alternatives, promoting sustainability and reducing reliance on fossil fuels.

Ontario has free trade agreements with 51 countries and products made in the province can be shipped around the world tariff-free. And with lowering the cost of business, we saw 85,000 new businesses open here in 2022 alone.

Vic Fedeli

Minister of Economic Development, Job Creation and Trade, Government of Ontario

The electric wave

Government incentives are one aspect of the electrification movement; the other is a growing demand from consumers. As Schaeffler’s Regional CEO Americas, Marc McGrath, affirms, “some communities are even advocating against the use of internal combustion engines due to increased noise and environmental concerns.”

A thought-provoking report compiled by BloombergNEF offers a glimpse into the future of transportation, where EVs are poised to dominate the global market. According to their analysis, it is predicted that 58% of all new passenger vehicle sales worldwide will be electric by 2040, effectively redefining the essence of mobility itself. In preparation for this imminent shift in consumer demand, OEMs such as Volkswagen are making strategic plans.

We have seen how EVs are beginning to overtake SUVs in terms of research interest. Three years ago, there were zero entries for electric cars in searches on Edmunds while today six out of the top twenty most researched vehicles are EVs.

Seth Berkowitz

President, Edmunds

Ralf Pfitzner, Head of Sustainability at Volkswagen tells us that “our Group anticipates that by 2030, electric vehicles will account for roughly half of global sales.” General Motors has also recognized this holistic movement and announced a $35 billion investment in electric and autonomous vehicles (AVs) by 2025. This substantial financial commitment signifies the shift taking place within their and other companies’ corporate DNA.

We are becoming a main player in the electric mobility transformation and staying true to our heritage of pioneering motion.

Marc McGrath

Regional CEO Americas, Schaeffler

of all passenger vehicle sales will be electric by 2040

The missing material

For all the excitement one can perceive in the voice of those involved in the electrification of the industry, some pressing issues remain unsolved, and few have concluding responses to them. This becomes evident when one examines the projected acceleration of EV production in both the U.S. and Europe, and juxtaposes it against the existing capacity of the supply chain responsible for procuring the critical materials required by this growth. CEO of Umicore, Mathias Miedreich, is one of the few to recognize the magnitude of this problem, telling us that “when you match the announced buildup of EV production in the U.S. and Europe against the capacity of the supply chain to provide the necessary critical materials, there is a gap of 10% to 30%.”

What is the consequence of such a problem? Volvo’s Head of Advanced Technology and Sustainability, Henrik Green, explains it in clear words: “Demand is currently higher than what we can supply, and our sales are thus supply limited.”

Why is the supply chain of critical materials so complex? In essence, critical materials, including lithium, cobalt, rare earth elements, and nickel, are vital to the EV industry, playing a crucial role in the production of batteries, electric motors, and other key components. These materials are not only essential but also inherently scarce, often concentrated in specific regions worldwide, which makes their extraction and procurement a complex endeavor.

Furthermore, the process of refining and transforming these raw materials into usable components involves supply chains that span multiple continents, encompassing mining, refining, manufacturing, and distribution. It is within this intricate web of interconnectedness that the gap between the growing ambitions of EV production and the supply chain’s capacity to keep up with escalating demand becomes apparent.

We have agreements with all of our battery suppliers; it does not matter where they are producing, if they are suppliers for BMW, we demand 100% renewable energy sources.

Thomas Becker

Chief Sustainability Officer, BMW

The percentage of EV battery minerals that must be sourced or processed domestically for U.S. buyers to qualify for a $3,750 tax credit.*

*Under rules proposed by the U.S. Treasury Department

The promise of autonomy

The AV industry will not develop a fully self-driving car until 2035, according to a recent prediction from research firm GlobalData. We expect the timelines for deploying fully autonomous vehicles (Level 5) to be pushed back over the next few years. However, autonomy is slowly permeating the industry, with tools such as ADAS (Advanced Driver Assistance Systems) – referring to a set of technologies designed to assist drivers and enhance vehicle safety by providing features such as collision avoidance, adaptive cruise control, and lane-keeping assistance – already being used worldwide.

Expected to hit the road first are autonomous trucks, which hold the potential to revolutionize the logistics industry. According to the CEO of Torc, a subsidiary of Daimler, “autonomous trucks will be available at scale by the end of this decade. We will probably start with slow volumes by the middle of the decade, and then grow step by step.”

But as the automotive industry embraces the era of autonomous and software-defined vehicles, it is crucial to acknowledge that there is a flip side to this technological advancement – the issue of security and hacking. Upstream CEO, Yoav Levy, tells us that “hacking cars is much easier today than it was five years ago when you needed to connect a computer to the car or know all the CAN-BUS networks,” highlighting the growing vulnerability. With vehicles becoming more connected and autonomous, the need for robust cybersecurity measures becomes paramount.

Buckle your seat belt

We are witnessing a truly remarkable transformation, propelled by rapid technological advancements and an unwavering pursuit of innovation. From sophisticated software-defined vehicles to autonomous driving which looms on the horizon, we are promised a future where vehicles can navigate and operate with minimal human intervention. To arrive there, the world must first embrace the urgency of electrification, the future of which hinges on the availability of critical minerals, a robust infrastructure, and the willingness of consumers to embrace this new paradigm. What is certain is that we are in for a truly exciting ride.

Share this article